What is “Peak Oil”?

I have referred to Peak Oil several times in earlier columns, so I think now I should go into a little more depth on the subject, and explain exactly what Peak Oil really is.

Oil is created deep under the earth from dead animal life (mostly plankton) dating from the dinosaur age. The dinosaurs, depicted so well in Jurassic Park, would, under ideal circumstances, be in our gas tanks now. Oil isn’t something that can be created instantly, or even in an average lifetime – it takes millions of years. Oil itself is made of long chains of carbon atoms, with a lot of hydrogen attached. When it’s burned, it produces heat (which is what makes it useful), carbon dioxide (believed by many to be responsible for climate change and global warming), and water vapour.

Coal, incidentally, is created in much the same fashion, but is mostly plant material. It consists largely of carbon, but with other trace elements, such as radioactive uranium and thorium, and mercury, one of the deadliest poisons in the ecosystem. When it burns, it produces a lot of heat (more than the same mass of oil), a lot of CO2, and it releases various highly toxic elements into the air we breathe, the water we drink, and the soil we grow our food in.

There are two critical concepts about oil (natural gas, coal, etc.):

- There is only so much oil in the world, and what we use will never be created again.

- We have been using oil as an energy source, at an ever increasing rate, for about 150 years. Every year we use more than we did the year before.

The first graph shows oil consumption throughout the world between 1980 and 2007. As you can see, US consumption has been rising slowly since about 1984, while Canada, Mexico and South America have remained relatively constant. Europe, despite rising population and wealth, has also remained relatively constant. Eurasia shows a decline since 1990 – this was the end of the USSR, so many countries on the southern fringe of Russia (e.g. Kazakhstan, Chechnya, Georgia) lapsed into even greater poverty.

When Will Peak Oil Happen?

Since around 1965, we have been using more oil each year than we have discovered. If one compares it to a bank account, we have been taking more out than we have been putting in. If we look at oil as a bank account, we’re heading for inevitable bankruptcy.

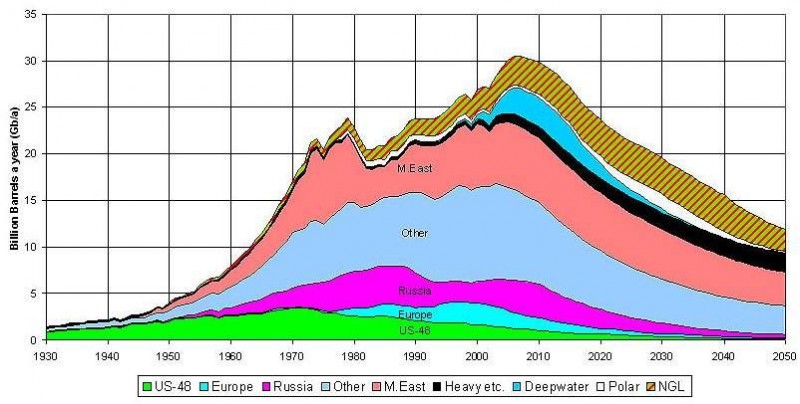

Peak oil is the period when the world’s production of oil is at its highest. After peak oil, it will decline steadily, year after year, until it is no longer economical to produce oil.

Many people, and almost all governments, think like economists, and this is what causes the problems. They consider a supply and demand situation. Put simply, if the supply of widgets isn’t enough to meet the demands of the market, the price will go up. As the price goes up, it becomes more profitable to make widgets, so another widget factory is built, supply meets or exceeds demand, and the price falls. Eventually, supply and demand will stabilise, leading to a relatively constant and fair price for widgets.

Most economists assume the same is true for oil. As supply goes down, price goes up. When the price goes up, it becomes profitable to extract oil which couldn’t have been extracted economically at the previous lower price. Production increases, and the price comes down for a while. If the price comes down too much, then the new sources of oil become uneconomical for the oil companies, so they stop producing it, supply goes down, price goes up….

This is what happened to the Alberta Tar Sands. Oil prices increased steadily, making it economical to manufacture synthetic crude from the tar sands; hence the boom in Fort McMurray, Alberta. After the oil price peak in 2008, prices nosedived, and oil plants in the tar sands started to shut down. Now, as oil prices are beginning a steady climb again, it’s almost full steam ahead in Northern Alberta.

In other words, supply and demand, just as economists predict with their widget model. The crucial difference, however, is that there is no theoretical limit to either demand or supply for widgets. And whilst there is no theoretical limit to demand for oil, there is very definitely a limit to supply, just as there is a limit to one’s bank account (even Bill Gates’s). The model breaks down – prices will go up, but the corresponding increase in supply is not going to happen.

Eventually, oil prices will be so high, no one is going to be able to afford it, big oil will go bankrupt, and nations which depend on oil, either as exporters or as consumers, will go bankrupt with them.

Any discussion about oil prices over the next decade must include an attempt to quantify emerging economy demand as an important driver at the margin. Here is a simple thought experiment using Chinese demand:

– China moves from 3 bbls/person/year to the South Korean per capita consumption level of 17 bbls/person/year

– Transition takes 30 years

– No peak in global production

In next 10 years we must find 44 million BOPD:

– 26 million BOPD to maintain supply – 30% of current production, almost 3 times Saudi Arabia’s output

– 18 million BOPD to keep up with demand – 22% of current production, almost 2 times Saudi Arabia’s output

If you superimpose peak production on top of this demand profile using the following parameters oil prices would increase approximately 250% in real terms over next 10 years:

– Oil demand elasticity of -0.3

– Current production 84 million BOPD, current price US$ 80

– Peak production 100 million BOPD

– Post peak decline rate of 3-4%

If you want to try the model for yourself using your own assumptions it can be found at: http://www.petrocapita.com/index.php?option=com_content&view=article&id=128&Itemid=86

Thank you, negconvexity. You’ve just given away part of the plot of the next article!

But thanks anyway! 🙂

Any discussion on this should include a consideration of the energy return on energy invested in extracting the oil.

Another factor is world population, due to get to about 9bn by mid century.

Should economists be discussing this at all? Didn’t someone say that continuous economic growth on a finite planet could only be supported by madmen and economists/

“Should economists be discussing this at all? Didn’t someone say that continuous economic growth on a finite planet could only be supported by madmen and economists”

Yes indeed. Please, stay tuned for the next articles in this thread, where I’ll discuss the political/economic consequences of peak oil, the social consequences, and what we can do to try and save ourselves.

Richard

Having worked in the petrochem industry for a number of years I have never seen a reduction in the amount of available hydrocarbons. Yes you are correct that eventually we WILL run out but that falls under sustainability.

In the 70’s when the US was lining up at the pumps and using the even/odd days fill up procedure, the Arab oil producing countries volunteered to increase production. It was denied for political leverage reasons in the US.

When gas prices spiked in 2008 in excess of a dollar there was no shortage of raw materials nor did the refineries reduce production. It was more a market issue from entities like hedge funds. The demand never surpassed the supply at any time. They also never tapped into the reserves

.

Also petrochemical companies do not earn quite as much from market value as anticipated. Yes they get quite rich from it however a good portion or a larger goes to people controlling market prices and banking types.

Also since the decline of the industrial revolution how is possible to increase the need for hydrocarbons? Factories are much more efficient then in the past. We have more cars but now they use less fuel however not as less as is possible

Many of the Asian continents cannot suit more automobiles as they lack the infrastructure and would require such an economic stimulus it is difficult to see happening.

smee brings up some good points. For instance Nuclear power. Recently advances have been made to shorten the waste life of nuclear material. It’s still not where we as a society probably want to be; but it’s an improvement. We can build better vehicles. We can use less oil. We can do a lot of things when we as a society are motivated.

There are solutions to just about any problem if you work honestly towards them. That being said we, every one of us, need to make sure that those we put in power focus on we voters want and what truly is best for society as a whole and not just those we golf with or who write us out donations at election time.